Home » Law » Laws by State »

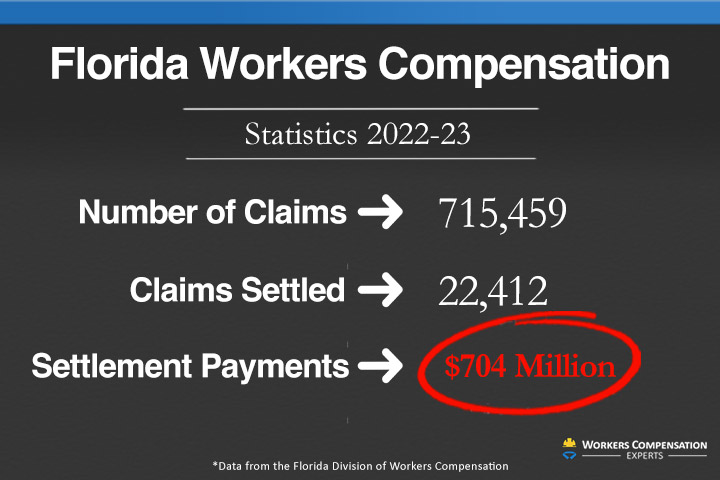

It doesn’t take more than a glance at the numbers involved with workers compensation in Florida to realize this system involves a lot of people … and a staggering amount of money!

There were 715,459 workers compensation claims in fiscal year 2022-2023.

Medical providers generated 3.8 million billing records for the injured men and women.

Insurance carriers paid nearly a billion dollars – $927,963,720 – for medical treatment.

The carriers paid another $703,956,273 in settlement claims.

Yet with all that money floating around, all parties involved – workers, employers, doctors, lawyers, insurance carriers and even judges – would welcome a legislative broom to sweep away many of the laws and rules that make it difficult to receive the benefits the system is supposed to provide.

“Workers comp in Florida works about 80% of the time,” said Glen Wieland, a lawyer who has been practicing workers comp in Orlando for nearly 40 years. “If the worker needs a couple of stitches to sew up a cut or somebody turns an ankle doing something, they go to the doctor, get the treatment they need, go back to work and everybody’s happy.

“But if you’ve got a serious injury or there are some unusual circumstances involved with the accident … watch out! You have no idea how the system is going to treat you.”

Every state in the U.S. likes to brag/complain/whine and argue about how the workers compensation laws in their state are unique and unfair, but Florida states its case loudly with just one law: In workers comp cases, the Insurance carrier always picks your treating doctor.

Read that sentence again: The insurance carrier ALWAYS picks your treating doctor.

“Imagine if the same system applied to your health insurance,” Wieland said. “Imagine if every time you needed a doctor, the insurance company got to pick the doctor for you.

“What would Americans have to say about that? People would be outraged. There would be a revolt!”

Wieland probably is right, but there is no revolution brewing over workers compensation, at least not in 2024. Flaws and all, the workers compensation laws haven’t changed much in Flor

ida the past 40 years. No one knows how they’ll change in the future, but access to medical care and the ability of the injured worker to have some voice in who treats their injuries are two areas that need to improve.

In the meantime, here are some ways to successfully comply with Florida’s workers compensation system.

Free Workers Comp Claim Evaluation

You deserve to be compensated fairly. Find out your rights and discover what your claim is worth.

How To File a Workers Comp Claim in Florida

Filing a workers’ compensation claim in Florida involves three key parties: the injured employee, the employer, and the insurance carrier. The process is straightforward but critical to ensure timely and appropriate support for injured workers.

The process starts with the employee promptly informing their supervisor about any workplace injuries or illnesses and, if necessary, seeking immediate medical treatment at a clinic or emergency room. Florida law says you have 30 days from the date of the accident to report the injury, although immediate reporting is encouraged to document incidents for potential future medical attention.

Upon notification of a work-related injury or illness, the employer should file a First Report of Injury with their insurance carrier within seven days. This report should contain detailed information about the injury, including its cause, date, time, and location. If the injured worker misses more than seven days of work, the employer must inform the insurance carrier within 14 days to initiate lost wages benefits.

The insurance carrier, upon receiving notification, must promptly file the First Report of Injury with the Florida Division of Workers Compensation. Within three days of notification, the insurer must send a brochure to the injured employee outlining their rights, benefits, and procedures for obtaining benefits. Throughout the recovery process, the carrier is responsible for updating the injured employee’s file with medical reports and wage statements.

What to Do If Your Workers Compensation Claim Is Denied

If your workers compensation claim in Florida is denied, don’t panic! Almost half of denied claims end up receiving benefits after going through the appeals process.

If you claim is denied, you can start the appeals process by contacting the Employee Assistance Office (EAOI) at 1-800-342-1741 or online. The EAO assists in the appeals process at no cost. They have seven offices statewide, but you must start the appeals process within two years of the injury date.

Another option is to hire an attorney, which probably should be your first option. Workers compensation law is complex. Hiring an attorney experienced in workers comp cases can significantly increase your chances of success.

The last option would be to file a “Petition for Benefit” which involves going to the Offices of Judges of Compensation Claims to resolve the dispute.

Reasons for Denial

There are a lot of reasons a workers compensation claim can be denied and not all of them are because the insurance carrier is trying to avoid paying.

Here are some of the reasons your claim can be denied:

- The injury did not occur at work

- The injury was caused by a pre-existing condition unrelated to the job

- Failure to meet reporting or filing deadlines

- Employer disputes that the injury was work-related

- Suspicions of exaggeration or substance abuse during the incident

- No witnesses to the injury

Remember, the appeals process can be lengthy and emotionally draining. Understand the process and seek help from a lawyer, if needed. While some claims are ultimately successful, preparation and persistence are key.

Eligibility for Workers Comp in Florida

In Florida, most employers are mandated to provide workers compensation insurance for their employees, but the specific coverage requirements for workers comp in Florida vary depending on the nature of the business and the number of employees.

Companies in the construction industry with one or more full-time or part-time employees are required to have workers comp insurance. Corporate officers can exempt themselves, but no more than three officers may do so.

Non-construction companies with four or more employees, whether full-time or part-time, must also have workers comp coverage.

Agricultural businesses with six or more regular employees and/or 12 seasonal employees who work more than 30 days must have workers comp insurance.

If you are an out-of-state employer or contractor, you must notify your insurance company to confirm your employees are covered by either a Florida workers compensation policy or an out-of-state policy with an endorsement listing Florida.

Some jobs don’t qualify for workers compensation insurance in Florida, including domestic servants in private homes, professional athletes, and individuals performing community service as part of a court sentence.

Search the Florida database of workers comp compliance to be sure your employer has workers comp insurance.

Workers Comp Benefits in Florida

There are three major categories of benefits in Florida’s workers compensation laws – medical; lost wages and death benefits – with several sub-categories that help determine how much you might receive and for how long.

Here is a look at each category of benefits and the sub-categories that influence how much is paid out and for how long.

» Learn More: What Does Workers Comp Cover in Florida?

Medical Benefits in Workers Compensation

When an employee sustains an injury, the priority for all parties involved – business owners, colleagues, and insurance carriers – is to ensure a swift recovery and return to work. Fundamentally, workers’ compensation covers all necessary medical expenses to achieve this goal.

Medical Benefits covered by workers comp in Florida include:

- Treatment provided by authorized doctors in approved facilities

- Use of an ambulance services, if necessary, to medical facilities

- Prescription drugs ordered by treating physicians

- Doctor visits for ongoing care and check-ups

- Medical tests and procedures

- Hospitalization, if necessary

- Physical therapy

- Attendant care

- Prostheses

- Mileage reimbursement for travel related to medical appointments and prescriptions

Be aware that failure to adhere to certain guidelines may result in your benefits being denied. For example, do not skip any appointments; seek treatment at authorized providers; do not pay bills sent to you; make sure you notify relevant parties about the injury.

If you aren’t sure about something, ask a claims adjuster from the insurance carrier.

Lost Wage Benefits

This is the benefit injured workers are most curious about, but know ahead of time, that it’s rare that anyone finds a pot of gold here. Lost wage benefits provide financial relief during recovery, but don’t fully compensate for the income loss. In Florida, injured workers typically receive 66.7% of their weekly wages, with a maximum cap of $1,260 per week.

Types of Lost Wage Benefits:

- Temporary Total Disability: Provided when the injury prevents the employee from returning to work for an extended period, typically up to 104 weeks but could be extended to 260 weeks.

- Temporary Partial Disability: Applicable when the employee can work but with restrictions, resulting in reduced income. You may collect TPD for 104 weeks.

- Impairment Income Benefits: Granted when the injury reaches maximum medical improvement, and compensation is based on the degree of impairment. Doctors evaluate your capabilities to determine what percentage (0%-100%) of your whole body is lost to that impairment.

- Permanent Total Disability: Awarded when the disability is deemed permanent. It provides income at 66.7% of average weekly pay until the age of 75.

Death Benefits

In the unfortunate event of an employee’s death due to a workplace injury, survivors may receive compensation, albeit with limitations. Death benefits, capped at $150,000, are disbursed weekly to the surviving spouse or children. Death benefits also include $7,500 toward funeral costs.

Limits on Workers Comp Benefits in Florida

Florida imposes time and financial constraints on workers’ compensation benefits. Temporary total disability benefits can last up to 260 weeks, with a maximum weekly payout of $1,260. Temporary partial disability benefits extend for 104 weeks, and permanent total disability benefits are provided until age 75.

Returning to Work Policy in Florida

The state encourages employees to return to work, even if they can no longer perform their previous roles. The Bureau of Employee Assistance and Ombudsman Office offers vocational counseling, job training, and placement services to facilitate re-employment. Eligible individuals can access these resources to explore alternative career paths and regain financial stability after they have been injured.

Sources:

- N.A. (2024, January 15) 2023 Results & Accomplishments Report Retrieved from https://www.myfloridacfo.com/docs-sf/workers-compensation-libraries/workers-comp-documents/reports/dwc-annual-reports/2023-ed-dwc-annual-summary.pdf?sfvrsn=946538f8_1

- N.A. (ND) The 2019 Florida Statutes. Retrieved from https://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&URL=0400-0499/0440/0440.html

- N.A. (2019, September) Workers’ Compensation System Guide. Retrieved from https://www.myfloridacfo.com/Division/WC/pdf/WC-System-Guide.pdf

- N.A. (2014, June 30) 69L-3.01915. Temporary Partial Disability Benefts (Dates of Accident on or After October 1, 2003). Retrieved from https://flrules.elaws.us/fac/69l-3.01915/

- N.A. (ND) Medical Benefits. Retrieved from https://www.myfloridacfo.com/division/wc/employee/Benefits/medical.htm

- N.A. (ND) Reemployment Services. Retrieved from https://www.myfloridacfo.com/division/wc/employee/reemployment.htm

- N.A. (ND) Workers Compensation Benefits. Retrieved from https://www.wcb.ny.gov/content/main/onthejob/wcBenefits.jsp

- N.A. (ND) Frequently Asked Questions. Retrieved from https://www.myfloridacfo.com/Division/WC/Employer/faq.htm

- O’Connor, A. (2016, June 9) Florida Supreme Court Strikes Down State Cap on Temporary Disability Benefits. Retrieved from https://www.insurancejournal.com/news/southeast/2016/06/09/411469.htm