Home »

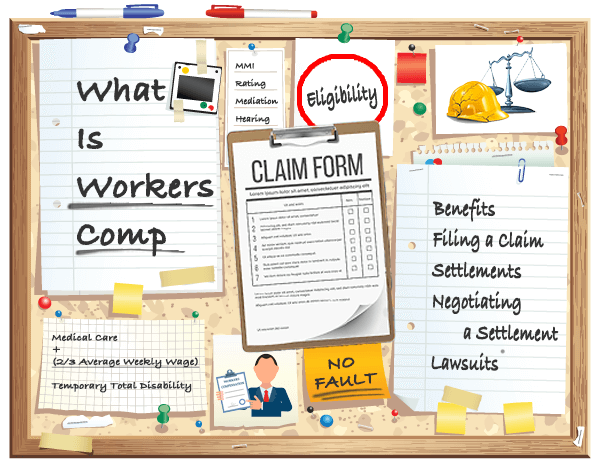

Workers compensation protects the employer from being sued, while also ensuring injured (and sickened) employees have access to necessary medical treatment, regardless of cost, and are compensated for wages lost during recovery and rehabilitation.

Workman’s comp also provides payments to an employee’s beneficiaries if the employee dies because of a work-related accident or illness.

Workers compensation is a “no-fault” program, meaning qualifying employees are entitled to benefits regardless of who caused the injury, as long as it was work-related.

It is important to note, however, there are situations when an employee must prove the injury or illness was sustained at work.

Workers compensation coverage is mandated in every state except Texas. The laws governing workers comp are enacted at the state legislature level and enforced by state agencies. Accordingly, it is safe to say many aspects of workers compensation – specifically, levels of benefits and ways in which those benefits are delivered – vary widely from state-to-state.

The history of workers compensation in the United States dates back to the early 1900s and was modeled after programs created in Germany and England. At the time, workers trying to recover medical expenses and lost wages had to sue their employer and prove negligence. The result was long, costly legal cases that usually favored employers over employees.

Historians cite the infamous 1911 Triangle Shirtwaist Factory fire in the Greenwich Village neighborhood of New York City as the tipping point for a national wave of legislation aimed at improving working conditions. When families of the 146 garment workers killed in the fire were awarded just $75 each in a civil suit — while the owners reaped a $60,000 insurance claim — popular outrage prompted state legislators to amend state constitutions and adopt workers compensation laws across the fruited plain.

Details of workers comp law vary by state. But certain fundamentals apply across the board.

What follows is a step-by-step explanation of how a workers comp case develops from start-to-finish. For the sake of brevity, anywhere you see “injured” or “injury,” you may apply “or sickened” or “or illness.”

Free Workers Comp Claim Evaluation

You deserve to be compensated fairly. Find out your rights and discover what your claim is worth.

Step 1: You’re Injured at Work

To file a claim successfully, you must be able to demonstrate your injury happened at work, or is work-related. No closely associated work connection? Then you have no claim.

Keep in mind, too, workplace injuries are not exclusively the result of accidents or other haphazard, one-off events. Some work-related injuries result from repetitive-motion stress, which can lead to aches and pains that merit workers comp benefits.

Additionally, state legislatures (and state courts) have begun recognizing work-related mental and psychological stress as an area for workers comp coverage.

Whatever the cause, it’s crucial you seek medical attention and begin the process of documenting your case. This is a no-brainer if a tumble from a ladder produces a fractured fibula, but is no less vital when you’re seeking relief from a strained shoulder after lifting 50-pound sacks or exposure to toxic chemicals.

Workers Comp Eligibility

Owners of a company may opt out of workers compensation insurance (and often do), but employees must be covered. The question about workers comp eligibility is: What exactly is the definition of employee and who exactly was he/she working for?

This discussion often comes up in situations where general contractors hire subcontractors and the subcontractors turn around and hire employees, and a few day-labor workers wander on to the job site and … well, you can see how this becomes an issue if there is an accident.

The IRS has a lengthy discourse on what defines an employee but not even their discussion comes to any specific conclusion. The IRS suggests weighing “common law rules” for behavior, financial renumeration and type of relationship.

In simple terms, an employee is anyone performs services for you in which you control what is done, how it will be done and how (s)he is compensated.

Long explanation short: If you’re an employee, you qualify.

Step 2: Report the Injury to Your Employer

OK, you’re injured and you’re an employee. So far, so good. You have seen a medical professional. Next up: You alert your employer — typically through your supervisor and/or the human resources department — about your work-related setback.

The report should trigger the beginning of the claim-filing process. Alert and responsible companies will create an incident report for the slightest accident, even if you come to the HR office looking for a bandage because you cut your finger on a staple.

Typically, all you have to do is notify your employer and they, along with the insurance company, will handle the claim. If there is a dispute, you can contact the workers compensation board in your state or enlist the services of an experienced lawyer.

Workers comp will cover all medical bills related to the injury as well as providing two-thirds of the injured worker’s average weekly wage while they are recovering.

Workers Comp Deadlines

Attorneys who specialize in workers compensation law are unified in their advice regarding reporting an injury and filing a claim: Sooner always is better; sooner always makes your case stronger.

We get it: You tweaked your back late on a Friday afternoon lifting heavy cartons onto warehouse shelves. Do you report it and get bogged down in paperwork with the weekend looming? Or, do you resolve to pursue self-care during your time off and see how things feel Monday morning?

Besides, what are your supervisor and coworkers going to think? Will they regard you differently if you complain?

“Legally, you can do that,” says Sarah Raaymakers, a personal-injury attorney based the Tampa Bay area. “It's just as with any type of insurance claim, the closer in time … the reporting occurs to when the event happens, the more seriously it's going to be taken, the better the preservation of evidence is.”

That rule of thumb established, state statutes dictate how long you have to file a claim. Alaska allows just 30 days. Nevada sets a 90-day deadline. At the extreme, Minnesota says it could be as far back as six years.

Most states, however, operate on a 1-2 year deadline after the injury occurs or the condition/illness is diagnosed.

Step 3: Your Employer Files a Claim

Typically, all you have to do is notify your employer and they, along with the insurance company, will handle the claim.

In turn, you will — or should — receive a first report of injury form. Review it carefully for errors, omissions, or incomplete information. For instance, be absolutely certain your rate of pay is accurately reflected. Make sure the report aligns with your version of events and the evidence you preserved.

Step 4: The Claim Is Investigated

Workers compensation fraud is big business, involving the bilking of more than $30 billion in losses to insurance companies annually, according to the Coalition Against Insurance Fraud.

Although popular in modern lore, the worker attempting to scheme the system is not the most common culprit. Instead, it’s employers misrepresenting their payrolls or the type of work performed to save on premiums.

Nonetheless, because their business model relies on collecting premiums and denying claims, the insurance company will assign a claims administrator to review the circumstances of your injury. And that may be that.

However, a workers comp investigator — often a private investigator, sometimes someone from an in-house team — may be dispatched to surveil the employee, and/or conduct interviews with relatives, friends, or coworkers.

The result of the administrator’s review and/or the investigator’s report will determine whether your claim is approved.

If there is a dispute, you may contact the workers compensation board in your state, or enlist the services of an attorney experienced in workers comp law.

Step 5: You Receive Workers Comp Benefits

Your claim is approved. Excellent. Ideally, workers compensation benefits cover medical costs needed to treat employees injured on the job and provide compensation (usually two-thirds of worker’s weekly salary) for wages lost while the employee recovers.

If the employee is permanently disabled by a work accident and can’t return to work, the program will pay benefits for ongoing medical care and lost wages.

It also should cover medical expenses if the injury or illness requires several weeks, months or years of rehabilitation.

Workers compensation also can cover funeral costs if the worker dies because of a work-related accident.

FAQs About Workers Comp

Lawsuits against employers over workplace injuries are vanishingly small. Workers compensation is a no-fault system, designed to protect both workers and employers from prolonged legal battles while ensuring access to medical care, rehabilitation, and lost wages benefits.

Certain rare circumstances do prevent themselves, however. Your employer intentionally attempted to hurt you, for instance.

Where it gets interesting is when a third party is involved. A defective product used at work contributed to your injury. Or, while driving for work, you were injured in a crash that was another driver’s fault.

It’s good to know your options.

“It’s so important,” says Peoria-based workers comp attorney Todd Strong, “in Illinois it’s considered legal malpractice not to investigate the possibility of a third-party claim. The standard of care for lawyers in Illinois is to investigate the facts of the case to determine whether there is any other responsible third party.”

A workers compensation settlement happens when the employee and insurance company agree on what benefits and compensation there will be, both medical and financial, to close the case for good.

Insurance companies want to get this over quickly so as soon as a doctor declares an employee has reached Maximum Medical Improvement (MMI), the insurer probably will offer to settle the claim.

It is wise to have legal representation when you suffer an injury, whether you choose to accept workers compensation or roll the dice and try to prove negligence on the part of the employer.

It is always possible to represent yourself, but it’s also foolish. Workers compensation law varies so dramatically from state-to-state and year-to-year that it is almost a guarantee you will need a lawyer to file your suit and take the steps necessary to win a judgment for yourself.

Sources:

- A. (2018, December 3) Workers' Compensation Statutes of Limitation by State. Retrieved from https://www.findlaw.com/injury/workers-compensation/workers-compensation-statute-of-limitations-by-state.html

- A. (2021, March 8) What You Don’t Know About Insurance Fraud. Retrieved from https://getforesight.com/workers-compensation-fraud/

- Rosanes, M. (2022, March 21) Revealed – The most common types of insurance fraud. Retrieved from https://www.insurancebusinessmag.com/us/news/breaking-news/revealed--the-most-common-types-of-insurance-fraud-399325.aspx

- N.A. (ND) Insuring Your Business: Small Business Owners’ Guide to Insurance. Retrieved from https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/specific-coverages/workers-compensation-insurance

- N.A. (ND) Employee (Common-Law Employee). Retrieved from https://www.irs.gov/businesses/small-businesses-self-employed/employee-common-law-employee

- Clayton, A. (2004) Workers’ Compensation: A Background for Social Security Professionals. Retrieved from https://www.ssa.gov/policy/docs/ssb/v65n4/v65n4p7.htm